MISSOULA — Filling your taxes can feel a little overwhelming, especially when it involves specific exemptions or multiple streams of income.

The University of Montana offers a Volunteer Income Tax Assistance program(VITA) every year for anyone in the community who meets the requirements.

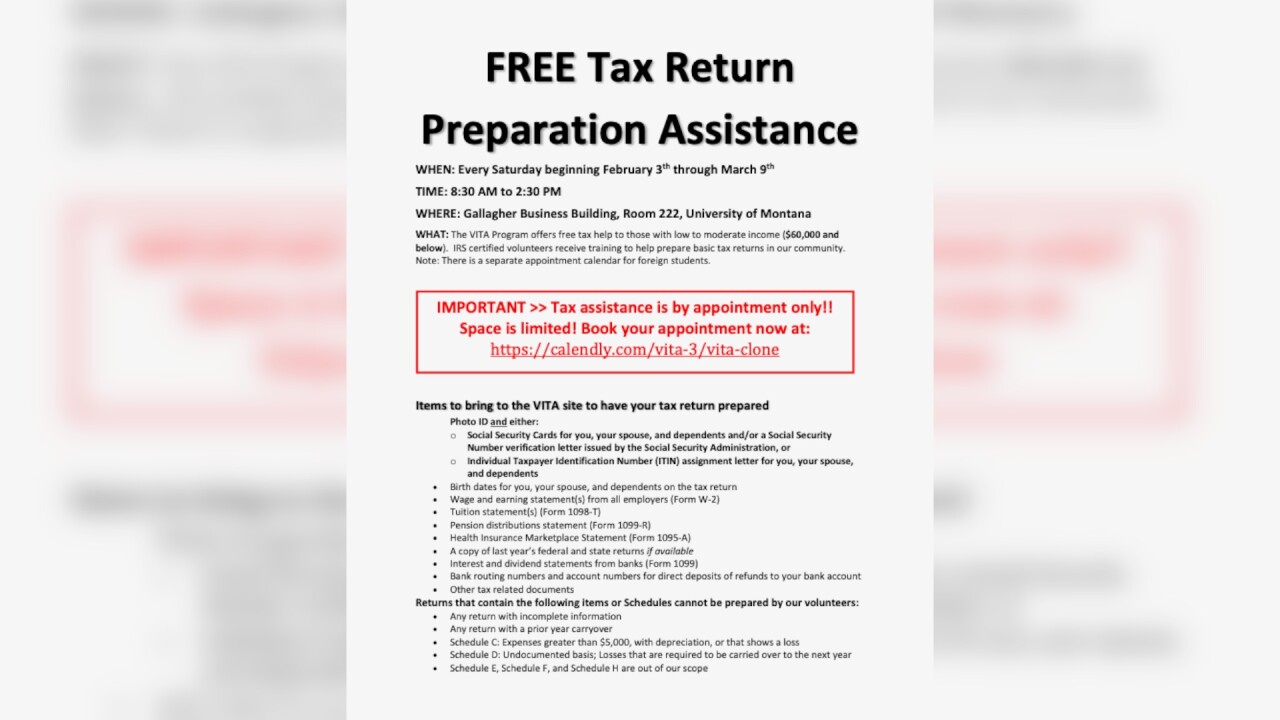

The clinic runs every Saturday between February 3 and March 9 by appointment only.

VITA has been offered at the university for at least 25 years, according to University Of Montana College Of Business Assistant Professor Leah Diehl.

“It’s a really unique program in that it’s mutually beneficial to both the students and the community,” Diehl said. “The students learn about how to prepare tax returns and then of course the community, we help them prepare and file their returns and hopefully get a nice tax return at the end of it as well.”

The assistant professor also sees her students apply their studies to real-life tax assistance through this program.

UM graduate student Hayden Wipple is volunteering at the VITA clinic as he wraps up the final semester of his master's degree in accountancy before becoming a Certified Public Accountant.

“It gives me experience working one-on-one with individuals and getting to know their tax situation and then making a connection personally so that I can use that to help them going forward,” Wipple said.

The tax clinic will also have a volunteer this year who is knowledgeable about Native American income tax filings.

“The average tax preparer in the U.S. is not going to study native American tax law,” said Tina Begay, Redtail Accounting CEO and University of Montana professor. “It just doesn’t happen, so you’re relying on a very select few people that do this, and probably most people that are running a tax clinic or tax service on a reservation know the rules.”

The Navajo Nation tribal member lives on the Flathead Indian Reservation. She's the owner of a bookkeeping business with more than three decades of experience in financial education.

"I started serving Indian Country in 2010 out of a pure necessity for native nonprofits that live in rural areas," she said.

Although Begay said there isn't a significant difference between the Non-Native American and Native American income tax filing process, there are exemptions that apply to Indigenous people.

“Some of the differences between a non-Native American and a Native American and their taxes I want to dispel,” Begay said. “I always hear that ‘Native Americans don’t pay taxes,’ and that’s just a myth. Native Americans do pay taxes. It depends on really how you're classified. There are basically two options. There’s a Native American tribe, and there’s a Native American individual. Native American tribes are exempt from federal taxes; Native American individuals are not. There are some exemptions to that rule. If you run a business that’s a treaty-right business, for example, fishing or fisheries, reindeer production, you would be exempt from federal taxes. It’s on a case-by-case basis.” - Redtail Accounting CEO and UM professor Tina Begay

Learn more about Native American tax preparation below:

- Montana Department of Revenue

- IRS Income Tax Guide and General Information

- Income Tax E-Learning website

The diverse group of volunteers is willing to help anyone in the community for free with their tax filing if they have a low to moderate income of $60,000 or below.

Other requirements and instructions on what to bring to the VITA clinic are listed below.